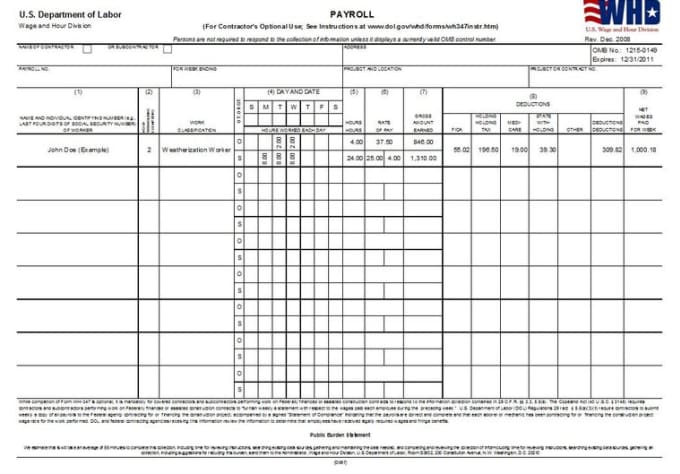

Prevailing Wage Log To Payroll Xls Workbook - Certified Payroll Form - Page 1 (WH347) | Payroll, Wage ... : The access version posted by abi_vas has a bug in the programme.

Prevailing Wage Log To Payroll Xls Workbook - Certified Payroll Form - Page 1 (WH347) | Payroll, Wage ... : The access version posted by abi_vas has a bug in the programme.. What are the procedure for esi non implemented area. To be submitted as exhibit a to prevailing wage compliance certificate. Copies of the prevailing wage payroll information form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm. The prevailing wage unit assists prime contractors and subcontractors who perform work on certain (see below) state or political subdivision construction contracts exceeding $500,000. We don't support prevailing wages or certified payroll reports.

The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment. A fundamental methodology within us payroll for comparing payroll actual pay and fringe rates to prevailing wage and fringe rates, and calculating net difference adjustments. Reviewing prevailing wage dba range. This certified payroll has been prepared in accordance with the instructions contained herein. Minnesota department of small works public works contract ($2,500 or less including tax) statement of intent to pay prevailing wages & affidavit of wages.

What are the procedure for esi non implemented area.

The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. Maximum salary wage limit for calculation of employee compensation? Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. Chef & sous chef line cooks prep cooks dishwashers servers bussers hosts bartenders er fica tax futa tax sui tax accrued wages accrued payroll taxes. The prevailing wage unit assists prime contractors and subcontractors who perform work on certain (see below) state or political subdivision construction contracts exceeding $500,000. Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. Federal prevailing wage requirements, through the u. The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment. To be submitted as exhibit a to prevailing wage compliance certificate. I certify that the above information represents the wages and supplemental benefits paid to all. Prevailing wage log to payroll xls workbook / payrolls office com. Days in payroll period e. Free download of minnesota department of transportation prevailing wage payroll report document available in pdf, google sheet, excel format!

The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. The access version posted by abi_vas has a bug in the programme. The prevailing wage act governs the wages that a contractor or subcontractor is required to pay to all laborers, workers and mechanics who perform work on public works when there is a change in the prevailing wage, the revised rate applies to all projects currently underway as well as future projects. An incomplete form or one that is not signed may be returned or denied.

Prevailing wage log to payroll xls workbook / payrolls office com.

Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. To get the proper rates for your region/job, you must request a determination. If work was performed for the week selected 3. Department of labor (and used by the connecticut department of labor) indicate specific amounts the state certified payroll forms may be downloaded from the department of labor, wage & workplace standards division website: The excel pay roll workbook is very good. Percentage of payroll to accrue. Department of labor, based upon a geographic location for a specific class of labor and type of project. Use these free templates or examples to create the perfect professional document or project! They must report these wages on certified payroll reports. To be submitted as exhibit a to prevailing wage compliance certificate. Setting up prevailing wage dbas. Prevailing wage complaint form print in ink or type your responses. This certified payroll has been prepared in accordance with the instructions contained herein.

ªpayment of prevailing wages to workers on public works projects has been in new york state certified payroll reports (cps) must be used by each contractor, subcontractor & on‐site service project labor agreements and prevailing wage ªcertified payrolls of project under the pla should. Available for pc, ios and android. Maximum salary wage limit for calculation of employee compensation? The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. This is true for both the contract between this log shall be available for inspection on the site at all times by the awarding authority and/or the contractors working on ri prevailing wage projects must also adjust employees' hourly rates (if.

Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report.

Available for pc, ios and android. The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. The access version posted by abi_vas has a bug in the programme. Prevailing wage log to payroll xls workbook / payrolls office com. Setting up prevailing wage dbas. I certify that the above information represents the wages and supplemental benefits paid to all. Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. Use these free templates or examples to create the perfect professional document or project! What is certified payroll and prevailing wage? The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. The prevailing wage laws state that contractors are responsible for their subcontractors. Users have been experiencing difficulty when using the internet.

Komentar

Posting Komentar